Aby Ba - Manager

Optilium advises growing small SMEs of digital:

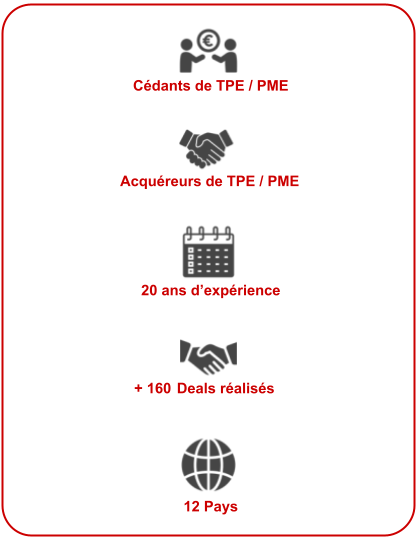

Optilium is made up of a team of experienced professionals with in-depth knowledge of the IT sector.

Born within the team of the investment bank Apm (acquired by Amala Partners in February 2022),  and its experts are dedicated to its development and has experience in high balance sheet operations for business leaders:

and its experts are dedicated to its development and has experience in high balance sheet operations for business leaders:

Within the framework of a corporate sale operation, Optilium provides its clients with a complete support through a process in 5 key steps:

1. Definition of the optimal structure in line with the expectations of management and shareholders

2. Elaboration of marketing documentation (Information Memorandum, teaser, ...)

3. Management of the divestment process: selection of the buyers' universe, contact with decision-makers, management of information exchanges and management meetings, ...

4. Management of the bid submission phases and negotiation of bids.

5. Follow-up of due diligence and transfer documentation: planning, coordination of stakeholders, negotiation of financial terms, etc.

A majority or minority capital restructuring (MBO, OBO, LBO, MBI...) often appears as a balancing act to be found between the interests of the different stakeholders in the operation (managers, outgoing shareholders, investors, bankers, mezzanine bankers, ...). Optilium assists its clients in this transition through a 4-step process:

1. Advice on the appropriate operation for the identified need: valuation, business plan, financial engineering, ...

2. Achieving marketing documentation (Information Memorandum, teaser, management presentation, ...).

3. Control of deadlines by an optimal management of those involved in the financing of the operation envisaged.

4. Negotiation and optimization of investment and financing clauses allowing the choice of investor counterparties and banks.

The acquisition of a company is a structuring step in the growth of businesses, whether it is a need for business diversification or market consolidation. Optilium assists its clients throughout the acquisition process, which can be summarized in 6 key steps:

1. Validation and analysis of the external growth strategy (probabilities of realization).

2. Identification of targets and validation of their relevance from a business point of view.

3. Direct contact with the management shareholders of these companies.

4. Management of exchanges with the target: meeting, information gathering, listening expectations, putting forward the buyer and his acquisition strategy, ...

5. Assistance in the financial valuation of the target.

6. Supervision of due diligence and organization of the closing of the transaction.

59, Rue des petits Champs- 75001 PARIS

ab@optilium.fr

For further information regarding our services feel free to contact us

Please submit your application with your resume to ab@optilium.fr